Some Ideas on Bank You Should Know

Wiki Article

The smart Trick of Bank Definition That Nobody is Talking About

Table of ContentsThe Single Strategy To Use For Bank Account NumberTop Guidelines Of Bank Draft MeaningBank Fundamentals ExplainedThe Ultimate Guide To Banking

You can additionally save your cash and also gain rate of interest on your financial investment. The cash kept in a lot of savings account is government guaranteed by the Federal Deposit Insurance Policy Company (FDIC), approximately a limit of $250,000 for specific depositors as well as $500,000 for jointly held down payments. Banks likewise offer debt chances for individuals as well as corporations.

Banks earn a profit by charging even more passion to consumers than they pay on interest-bearing accounts. A financial institution's size is identified by where it lies and that it servesfrom small, community-based establishments to big business financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured business financial institutions in the United States as of 2021.

Traditional financial institutions use both a brick-and-mortar location and also an on the internet visibility, a new trend in online-only banks emerged in the very early 2010s. These banks often supply consumers greater passion prices and also lower charges. Ease, rates of interest, and also costs are a few of the factors that aid consumers choose their preferred banks.

The Single Strategy To Use For Bank Code

banks came under extreme analysis after the worldwide monetary situation of 2008. The regulatory environment for banks has actually considering that tightened considerably as a result. United state banks are regulated at a state or nationwide degree. Relying on the framework, they may be controlled at both levels. State financial institutions are managed by a state's division of banking or department of financial establishments.

, for example, takes deposits as well as offers in your area, which can offer a much more tailored financial relationship. Select a convenient location if you are picking a bank with a brick-and-mortar location.

8 Easy Facts About Bank Reconciliation Shown

Some banks likewise use smartphone applications, which can be useful. Some big banks are relocating to end overdraft fees in 2022, so that could be an important factor to consider.Financing & Development, March 2012, Vol (bank reconciliation). 49, No. 1 Institutions that compare savers and debtors aid make certain that economic situations work smoothly YOU'VE got $1,000 you do not require for, say, a year as well as want to gain income from the cash up until after that. Or you desire to get a home and need to borrow $100,000 as well as pay it back over 30 years.

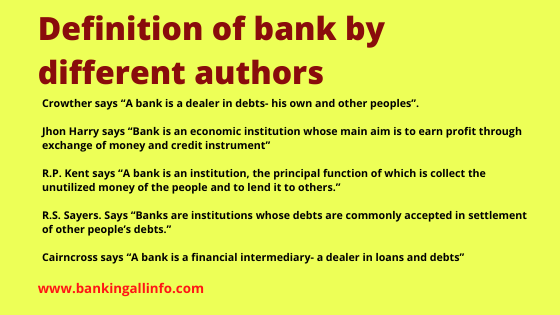

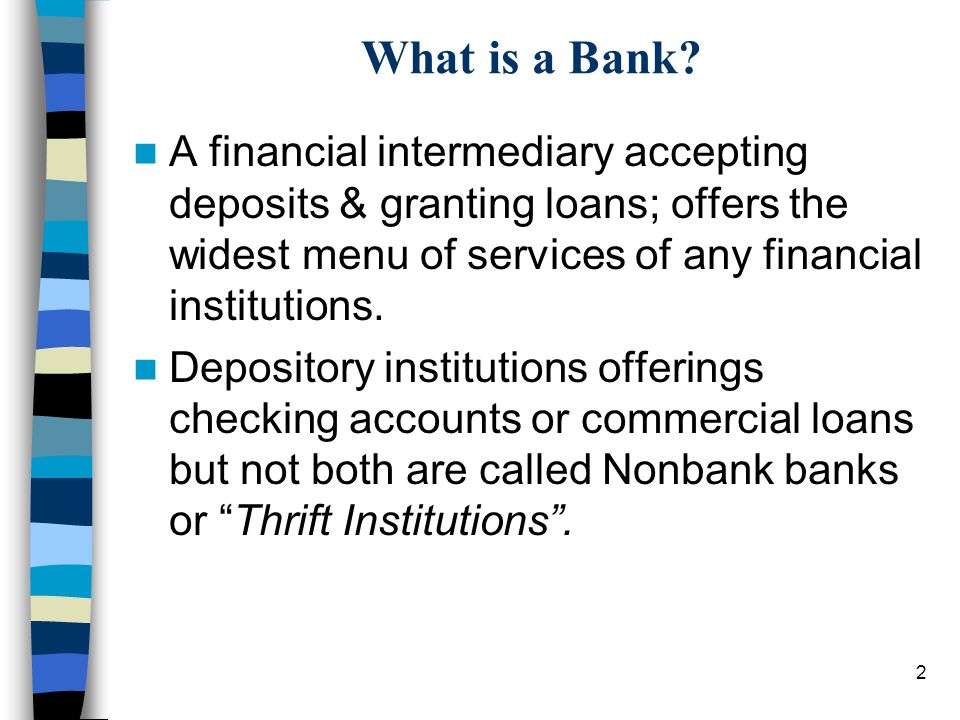

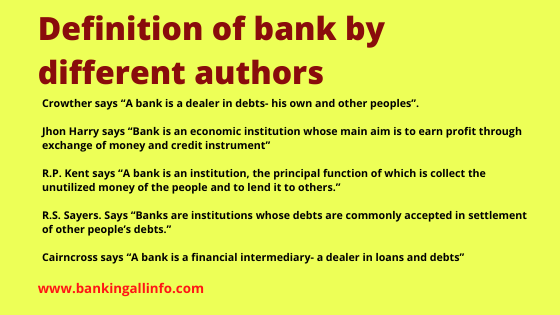

That's where financial institutions come in. Financial institutions do numerous points, their key duty is to take in fundscalled depositsfrom those with money, pool them, and provide them to those who require funds. Financial institutions are middlemans in between depositors (that provide money to the financial institution) as well as debtors (to whom the bank provides cash).

Deposits can be available on demand (a monitoring account, for instance) or with some limitations (such as financial savings and time deposits). While at any type of given minute some depositors need their money, the majority of do not.

Bank Definition - Truths

The process includes maturation transformationconverting short-term responsibilities (deposits) to long-lasting properties (fundings). Financial institutions pay depositors much less than they obtain from borrowers, which distinction accounts for the bulk of banks' earnings in a lot of nations. Financial institutions can enhance traditional deposits as a resource of funding by straight obtaining in the cash and also resources markets.

Financial institutions keep those required reserves on down payment with reserve banks, such as the United State Federal Book, the Financial Institution of Japan, and also the European Central Bank. Financial institutions develop money when they provide the remainder of bank bar bgc menu the cash depositors offer them. This cash can be made use of to acquire goods and also solutions and can find its back into the financial system as a deposit in one more financial institution, which after that can lend a fraction of it.

The size of the multiplierthe amount of cash created from a first depositdepends on the amount of money financial institutions have to maintain on get (bank reconciliation). Financial institutions additionally offer and also reuse excess cash within the economic system and develop, distribute, as well as profession safeties. Financial institutions have a number of methods of generating income besides taking the difference (or spread) between the passion they pay on down payments and also obtained cash as well as the interest they gather from customers or safeties they hold.

Report this wiki page